Our Annual Awards aim to guide traders through the often complex forex market by recognising brokers that truly deliver in areas tat matter most—spreads, usability, and trust.

Under the leadership of Justin Grossbard, our CEO and Head of Research, CompareForexBrokers combines years of industry experience with a finetuned methodology to ensure our awards reflect genuine excellence.

“As part of this year’s awards, we’ve tested and reviewed over 40 brokers to identify those offering the lowest fees, the best trading platforms, and setting the standard in niche areas like education and risk management,” explains Justin Grossbard. “We also assessed brokers outperforming their competitors in specific financial markets, such as forex, crypto, and shares, alongside the prestigious award for the Best Forex Broker Overall.”

#1 Best Broker Overall for 2026

Winner: Pepperstone

Outstanding Achievement: IC Markets, OANDA, Eightcap

Methodology: Selecting the Best Broker Overall requires a holistic approach to evaluating performance across critical areas that traders value most. Our team begins by assessing global regulatory oversight, ensuring the broker operates under Tier 1 licenses from authorities like ASIC, FCA, and CFTC. We then examine platform functionality, including access to tools like MT4, MT5, and TradingView, to cater to a variety of trading strategies.

In addition, we evaluate execution speeds, customer support quality, and the broker’s ability to deliver low trading costs through competitive spreads and commissions. Client feedback and real-world trading data are also considered to ensure our results reflect actual trader experiences. The brokers in this category must demonstrate consistent excellence across these metrics, providing a reliable, user-friendly, and secure trading environment for all levels of experience.

After weighing up key criteria such as spreads, platform choice, broker trust, and customer service, Pepperstone scored 98 out of 100 to take out our Best Broker Overall award.

Pepperstone allows you to choose from five trading platforms, including MT4, MT5, cTrader, TradingView, and its own Pepperstone Trading app. This variety means Pepperstone has the right platform for all trading styles, from scalping and automation to copy trading and discretionary trading.

To trade with Pepperstone, no minimum deposit is required and you can choose from their Razor Account with spreads from 0 pips (and $3.50 commission per lot) or their Standard Account with spreads from 1.0 pips.

Regardless which account you choose, from over 1350 CFD financial instruments including 94 Forex pairs, 44 cryptocurrencies, 24 indices and 95 ETFS. You can also trade CFD stocks, hard and soft commodities like gold and CFD forwards (aka futures). When trading Forex, leverage can range from 30:1 to 1000:1, depending which region you are trading from.

Trading Platform Awards

A broker’s platform is its backbone, and the Trading Platform Awards category focuses on brokers that deliver top-tier tools and functionality.

Whether you’re a beginner learning the ropes or an experienced trader using automated strategies, these platforms provide the features and flexibility to suit a variety of trading approaches.

We assess user experience, tool availability, and integration options to identify platforms that truly enhance trading efficiency.

#1 Best MT4 Broker

Winner: Pepperstone

Outstanding Achievement: BlackBull Markets, IC Markets, Eightcap

Methodology: Selecting the Best MetaTrader 4 (MT4) broker involved comparing each brokers offerings of the worlds most popular trading platform. Execution speed, competitive spreads, platform reliability, Expert Advisors, and integration with additional add-ons were considered.

We also reviewed market accessibility, account flexibility, and regulatory compliance to ensure a secure and efficient trading environment. This award highlights brokers that offer an exceptional MetaTrader 4 experience, balancing affordability, performance, and support for both beginner and advanced traders.

After assessing key criteria such as spreads, platform choice, broker trust, and customer service, Pepperstone scored 98 out of 100 to take out our Best MT4 Broker award. Its combination of low trading costs, strong regulation, and MT4-friendly trading conditions makes it a standout choice if you trade on MetaTrader 4.

Pepperstone provides a fully optimised MT4 trading environment with no restrictions on scalping, hedging, or automated trading using Expert Advisors (EAs). This makes it an excellent choice if you run algorithmic or high-frequency strategies, while still catering to discretionary MT4 trading.

You can access MT4 through Pepperstone’s Razor Account, which offers spreads from 0.0 pips plus a $3.50 commission per lot, or the Standard Account with spreads from 1.0 pip and no commission. No minimum deposit is required, making it easy for you to get started.

Regardless of which account you choose, you can trade over 1,350 CFD instruments, including 94 forex pairs, cryptocurrencies, indices, ETFs, commodities, and CFD stocks. When trading forex, leverage ranges from 30:1 to 1000:1 depending on your region, giving you flexibility to match your strategy.

#1 Best MT5 Broker

Winner: IC Markets

Outstanding Achievement: Eightcap, Pepperstone, BlackBull Markets

Methodology: The Best MetaTrader 5 (MT5) Broker award recognises those that excel in delivering a superior MT5 trading experience. We assessed key metrics, including trading costs, execution speeds, platform reliability, and the range of available instruments.

Additionally, we evaluated how well brokers integrate advanced MT5 features like Depth of Market (DOM), algorithmic trading, and multi-asset support. Regulatory compliance and customer support were also considered to ensure a safe and accessible trading environment for users at all levels.

#1 Best Third-Party Trading Platform

Winner: TradingView

Outstanding Achievement: MT4, MT5, cTrader

Methodology: This award evaluates platforms on functionality, ease of use, and broker compatibility. Our team tested platforms across key metrics like charting tools, customisation options, automation features, and execution speed. We prioritised platforms that support seamless integration with brokers and cater to a variety of trading styles.

#1 Best Trading App

Winner: ThinkMarkets

Outstanding Achievement: FXCM, Eightcap, Pepperstone

Methodology: The Best Trading App award recognises the mobile platforms that deliver exceptional functionality, ease of use, and reliability for forex and CFD traders.

We tested a range of trading apps across Android and iOS devices, assessing their execution speeds, charting tools, user interfaces, and real-time data availability. The award winner excelled in offering a seamless trading experience, backed by ASIC regulation, robust features, and consistent performance in variable network conditions.

ThinkTrader (formerly called ‘Trade Interceptor’) developed by ThinkMarkets in our opinion is the best trading app on the market. With charting from TradingView (the best charting tools on the market), 120 indicators, 50 drawing tools, 19 chart types this app has the best technical analysis tools available. You can also monitor up to 8 charts at once which is something few other trading apps can offer.

The app also comes with features such as TrendRisk Scanner, Traders’ Gym, and Signal Centre to help with risk assessment, backtesting, and market sentiment.

ThinkMarkets allows you to trade over 400 trading instruments, starting from 0.0 pips with the ThinkZero account (with $3.50 commission per lot) and 0.4 pips with the Standard account. Other platforms available include MT4, MT5 and TradingView.

#1 Best Risk Management Tools

Winner: City Index

Outstanding Achievement: Pepperstone, BlackBull Markets, OANDA

Methodology: The Best Risk Management Tools award identifies brokers that provide the best features to help traders minimise losses and manage their capital effectively.

Our team assessed brokers across key criteria, including access to tools like guaranteed stop-loss orders, negative balance protection, margin close-out levels, and risk calculators. Brokers were also evaluated for educational resources that enhance traders’ understanding of risk.

The winner, City Index, stands out for its comprehensive range of risk tools, making it an excellent choice for cautious and strategic traders.

#1 Best cTrader Broker

Winner: Fusion Markets

Outstanding Achievement: IC Markets, FxPro, Pepperstone

Methodology: The Best cTrader Broker Award highlights platforms offering superior trading experiences on cTrader. Our team evaluated brokers on key factors such as platform usability, execution speed, low spreads, and access to advanced tools like Level II pricing and automated trading capabilities.

We focused on brokers that provide robust support for cTrader’s powerful features, including advanced charting tools, custom indicators, and seamless trade execution. This category is designed to help traders find brokers that maximise the unique strengths of cTrader.

#1 Best TradingView Broker

Winner: Eightcap

Outstanding Achievement: BlackBull Markets, Pepperstone, City Index

Methodology: Our team evaluated brokers offering TradingView integration to determine which delivers the best overall experience. We assessed factors like seamless platform connectivity, access to TradingView’s advanced charting features, and execution reliability.

Key criteria included pricing (spreads and commissions), market coverage, and whether brokers offer enhanced TradingView features, such as TradingView Pro, as part of their service. We also looked at platform usability, customer support, and additional tools available for analysis and trade execution.

The winning broker excels in providing smooth integration, competitive costs, and a trading environment that fully utilises TradingView’s capabilities for both technical analysis and execution.

As one of the fastest growing trading platforms (100+ million users) and one of the best choices for technical analysis, TradingView is our pick for best third-party trading platform.

Tradingview comes with a quality range of charting and analysis tools. 20+ different chart types are available giving you great flexibility for trading strategies. To help with your analysis multiple charts per layout can be displayed at one time and these charts consist of 400 built-in technical indicators and 110 drawing tools. If this is not enough you can also access 100,000 publicly available indicators.

Other features that will appeal include custom alerts, social trading for ideas sharing and Pine script to build custom indicators.

Overall we recommend Eightcap as the best broker for TradingView.

Lowest Cost Brokers

Trading costs can significantly impact your overall profitability, and our Lowest Cost Brokers category highlights brokers that offer the most competitive pricing. From low spreads to minimal commission fees, these brokers help traders reduce expenses without sacrificing quality.

Our analysis considers average spreads, account fees, and other charges, ensuring that these brokers provide cost-effective solutions for both high-frequency and long-term traders.

#1 Best Raw Account Spreads

Winner: Eightcap

Outstanding Achievement: IC Markets, Pepperstone, Fusion Markets

Methodology: The best raw account spreads award focuses on identifying brokers that consistently deliver tight spreads with low commission fees. We tested live accounts to evaluate spreads on major forex pairs, such as EUR/USD, GBP/USD, and AUD/USD, and factored in commission costs to determine overall trading expenses.

Additionally, we assessed execution speeds to minimise slippage and platform reliability to ensure a seamless trading experience. The winning broker needed to balance competitive pricing, platform performance, and regulatory compliance to provide traders with a cost-efficient environment for both scalping and long-term strategies.

Eightcap wins the sought after award for low raw account spreads, offering some of the tightest pricing in the market. With spreads starting as low as 0.06 pips on EUR/USD and competitive rates on major and minor pairs, it’s ideal for scalpers and high-frequency traders.

#1 Best Standard Account Spreads

Winner: IC Markets

Outstanding Achievement: CMC Markets, Fusion Markets, Pepperstone

Methodology: The Best Standard Account Spreads award recognises brokers offering the tightest average spreads without charging commissions. Our team conducted rigorous testing across 15 brokers using MetaTrader 4, focusing on six major currency pairs.

By analysing spread consistency, cost stability, and overall pricing transparency, we identified brokers that deliver the most cost-effective trading conditions for standard accounts. These brokers excel in maintaining low spread costs, enabling traders to minimise expenses while avoiding commission fees, making them ideal for both beginners and experienced traders.

#1 Lowest Commission in Australia

Winner: Fusion Markets

Outstanding Achievement: Pepperstone, GO Markets, FP Markets

Methodology: The Lowest Commission in Australia award highlights brokers offering the most cost-effective trading conditions for Australian traders. Our team evaluated brokers regulated by ASIC, focusing on RAW accounts with fixed commissions and spreads starting as low as 0.0 pips.

We analysed commission rates for AUD-based accounts to determine the true trading costs, with DNA Markets and Fusion Markets tied for the lowest commission at $2.25 per lot. This award recognises brokers that provide transparent and affordable options for high-frequency and cost-conscious traders.

#1 Lowest Commission in Europe

Winner: Tickmill

Outstanding Achievement: GO Markets, Pepperstone, Eightcap

Methodology: The Lowest Commission in Europe award identifies brokers that offer exceptional value for EUR-based traders. Our analysis compared commission rates and spreads for RAW accounts among brokers regulated in the EU, with a focus on CySEC-approved options.

Tickmill is the winner, closely followed by GO Markets with €2.00 per lot commission fees, delivering the lowest overall trading costs. This category celebrates brokers committed to providing competitive pricing and transparency for European traders.

#1 Best Fixed Spread Broker

Winner: Trade Nation

Methodology:

TradeNation is the best choice for fixed spreads with spreads of 0.6 pips for EUR/USD, 0.7pips for AUD/USD and 1.2 pips with EUR/GBP. These spreads are as tight as spreads found on Standard accounts with other brokers so they are top value if you scalp trade or are risk-averse and require predictable spreads.

To get fixed spreads, choose the TN Trader or TradingView platforms. Choosing TN Trader offers the added benefits of a guaranteed stop-loss order, instant execution, and access to Trade Nations’ full range of 1000+ trading products. Should you prefer variable spreads, MetaTrader 4 is available.

Best Brokers by Trading Instrument

Our team evaluated brokers across key markets to identify those offering the best trading conditions. This category includes forex, commodities, cryptocurrencies, share CFDs, and other asset classes, ensuring traders can find brokers suited to their specific needs.

We assessed pricing, including spreads and commissions, the breadth of tradable instruments within each market, and the leverage options available for balancing flexibility with risk management.

#1 Best Broker for Gold Trading

Winner: XM

Methodology: The best brokers for gold trading were based on 4 main criteria. The first criterion is the cost or spreads for trading gold; the lower the spread, the higher the score we gave broker.

The second criteria range of gold products available, most brokers limit gold to USD only but a few brokers also offer gold vs other fiats like EUR, GBP and AUD and even BTC.

The third criteria is the range of metals available. While Gold is a category in itself, brokers that offer related metals like Silver, Palladium, Platinum and Copper score more as it indicates the broker is more serious about this market. We also factored in whether other commodities such as energies and soft commodities like agricultural products, are available.

The last criteria considered are the platforms available for Trading Gold. MT4, MT5 and TradingView tend to be the most popular.

XM is the best broker for gold trading, with Gold starting from 1.2 pips and averaging 2.0 pips, XM is very competitive. Other products available include Gold vs Euro (XAUEUR) and Silver plus Palladium and High Grade Copper. Platinum. You can also trade energies (cash and futures) and 8 agricultural products.

To trade these products with XM, you can choose between MetaTrader 4, MetaTrader 5 and the XM app.

To get started trading with XM, you can choose between their Ultra Low or Zero Account. Both have a $5 minimum deposit but there are some differences to note. Ultra Low is commission-free and available as a swap-free option and can be traded in micro lots. The Zero account has gold spreads from 1.2 pips with a commission of $3.50 per lot, but not a swap-free or micro-lot option.

#1 Best Broker for Silver Trading

Winner: FXCM

Methodology: The best brokers for silver trading were assessed using four key criteria.

The first criteria is the cost of trading silver, including spreads and any applicable commissions. Brokers offering tighter spreads on silver markets scored higher, particularly those with consistently low average spreads rather than headline minimums.

The second criteria is the range of silver products available. While many brokers only offer Silver against USD (XAG/USD), higher scores were given to brokers that also offer silver priced against other currencies such as EUR, GBP, or AUD, or provide multiple silver contract types (spot, mini, or futures-style CFDs).

The third criteria is the broader metals and commodities offering. Brokers that support silver alongside other precious and industrial metals such as gold, platinum, palladium, and copper ranked higher, as this indicates stronger depth in commodities trading. We also considered access to related commodity markets such as energies and agricultural products.

The final criteria is the trading platforms available for silver trading. Brokers offering MetaTrader 4, MetaTrader 5, and TradingView scored highest, as these platforms provide advanced charting, execution, and risk management tools suitable for metals trading.

#1 Best Broker for Oil Trading

Winner: Capital.com

Methodology: The best brokers for oil trading were evaluated based on four primary criteria.

The first criteria is the cost of trading oil, including spreads, commissions, and overnight financing. Brokers offering competitive spreads on key oil benchmarks such as WTI and Brent crude received higher scores, particularly where pricing remained stable during volatile market conditions.

The second criteria is the range of oil products available. Brokers scored higher if they offered access to multiple oil benchmarks, including WTI, Brent, and regional crude contracts, as well as different contract types such as spot oil, cash CFDs, and futures-style CFDs.

The third criteria is the overall commodities offering. Brokers that provide oil trading alongside other energy products such as natural gas, heating oil, and gasoline, as well as metals and soft commodities, scored higher as this reflects a more comprehensive commodities trading environment.

The final criteria considered is the trading platforms available for oil trading. MetaTrader 4, MetaTrader 5, and TradingView were prioritised due to their strong support for commodities charting, order execution, and technical analysis.

#1 Best Broker for Futures Trading

Winner: Plus500

Methodology: The best brokers for futures trading were ranked using four main criteria.

The first criterion is the cost of trading futures, including commissions, spreads, and exchange-related fees. Brokers offering transparent pricing structures and low per-contract or CFD-based costs scored higher, particularly for active traders.

The second criterion is the range of futures markets available. Brokers received higher scores if they offered access to futures across multiple asset classes, including indices, commodities, energies, metals, and agricultural products, rather than focusing on a single market type.

The third criterion is the quality of futures trading conditions. This includes execution speed, contract specifications, leverage options, and the availability of risk management tools such as stop-loss orders and margin controls.

The final criterion is the trading platforms supported for futures trading. Brokers offering advanced platforms such as MetaTrader 5, proprietary futures platforms, or

TradingView scored higher, as these platforms are better suited to futures trading than MT4.

#1 Best Broker for Stock Trading

Winner: Interactive Brokers

Methodology: The best brokers for stock trading were based on 4 main criteria.

The first criteria is the cost or spreads for trading stocks; the lower the spread, the higher the score we gave broker. Some brokers have a commission in addition to the spread while other brokers are spread only, so these considerations are factored in.

The second criteria range of stock products to choose from. Some brokers limit stock products to the NYSE and NASDAQ exchanges in the US only and sometimes only offer the most popular stocks from that market. Brokers that got higher scores offer stocks from exchanges across the globe like ASX (Australia), LSE (London) and EuroNext (Europe).

The third criteria are related products to stocks. Many stock traders also like to trade indices and ETFs, which involve the trading of stocks.

The last criteria considered are the platforms available for Trading stocks. MT5, cTrader TradingView tend to be the most popular, MT4 generally isn’t a good choice for stocks trading.

#1 Best Range of Markets

Winner: Vantage Markets

Outstanding Achievement: IG, CMC Markets, Saxo Markets

Methodology: This award highlights brokers with broad market coverage, spanning forex pairs, shares, cryptocurrencies, commodities, indices, ETFs, and bonds.

Our assessment focused on the range of tradable instruments, leverage options, and suitability for diverse trading strategies. Brokers outperforming their peers in offering access to multiple markets while also supporting both CFD and stock trading were given extra points.

#1 Best Broker for Forex

Winner: Pepperstone

Outstanding Achievement: IC Markets, BlackBull Markets, Eightcap

Methodology: This award recognises the top forex broker based on trading costs, platform performance, and market accessibility. Our team evaluated 40 brokers, focusing on spreads, execution speeds, and regulatory oversight. The winning broker excelled in offering low trading fees, diverse currency pairs, and advanced tools, making it an ideal choice for forex traders of all levels.

Pepperstone earns the top spot for forex trading, offering tight spreads from 0.0 pips on its Razor account and ultra-low commissions of $3.50 per side. The broker’s forex-focused platform options—MetaTrader 4, MetaTrader 5, cTrader, and TradingView—cater to both technical and algorithmic traders. With over 60 forex pairs, including majors, minors, and exotics, Pepperstone delivers flexibility for all strategies, from scalping to swing trading.

#1 Best Broker for Crypto

Winner: Eightcap

Outstanding Achievement: Pepperstone, IC Markets, XTB

Methodology: Our best broker for cryptocurrency trading award evaluates brokers based on their crypto CFD offerings, focusing on token variety, competitive spreads, platform integration, and leverage options. We also assessed account features like minimum deposits, execution reliability, and risk management tools to identify the top broker for crypto traders.

#1 Best Broker for Share Trading

Winner: Interactive Brokers

Outstanding Achievement: IC Markets, CMC Markets, eToro

Methodology: Our tested a range of brokers that offer stock trading serviecs to find the best broker for share trading. We focused on those offering direct access to global exchanges, competitive commission structures, and advanced research tools. This award highlights brokers that cater to both casual and active share traders with tools designed to optimise performance.

#1 Best Broker for Share CFDs

Winner: FP Markets

Outstanding Achievement: ThinkMarkets, CMC Markets, eToro

Methodology: This award recognises brokers offering top-tier conditions for share CFD trading. Our analysis included trading costs, platform features, execution speeds, and the range of share CFDs available.

The winner stands out for providing a broad selection of share CFDs, competitive spreads, low commissions, and advanced tools like real-time data and customisable charts. With efficient execution and strong risk management options, this broker is well-suited for share CFD traders.

#1 Best Broker for Indices

Winner: CMC Markets

Outstanding Achievement: Pepperstone, IC Markets, Eightcap

Methodology: This award recognises the top broker for index trading, chosen for its low spreads, fast execution speeds, and access to a broad range of global indices. Our evaluation focused on brokers offering indices across key exchanges like the S&P 500, FTSE 100, and DAX, alongside platform performance and cost efficiency, ensuring the best options for index traders.

#1 Best Broker for Commodities

Winner: City Index

Outstanding Achievement: Pepperstone, IG, CMC Markets

Methodology: This award recognises the broker offering the best trading experience for commodities. Our team reviewed spreads, trading fees, platform functionality, and available CFDs, such as gold, oil, and natural gas. The winning broker stood out with its combination of competitive pricing, fast execution speeds, and a wide selection of tradable commodities.

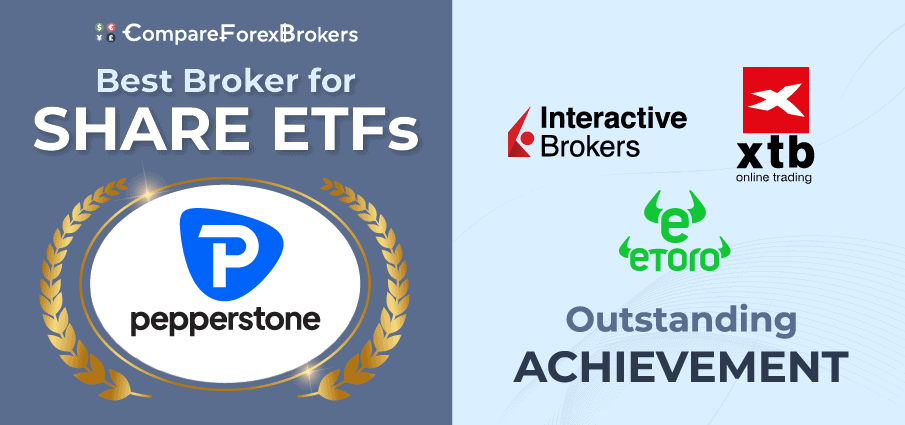

#1 Best Broker for ETFs

Winner: Pepperstone

Outstanding Achievement: Interactive Brokers, XTB, eToro

Methodology: The Best Broker for ETFs award highlights brokers that excel in ETF trading by providing low fees, a wide range of ETF options, and intuitive platforms. Our analysis considered trading costs, platform usability, and ETF availability. The winner offers exceptional access to global ETFs, advanced charting tools, and seamless execution, making them the top choice for ETF traders.

Specialty Awards

The Specialty Awards recognise brokers that go above and beyond in specific areas like education, risk management, or innovation.

These brokers address the needs of niche traders, offering targeted solutions that improve the overall trading experience. By analysing unique features and specialised services, we highlight the brokers providing valuable resources for traders with distinct goals.

#1 Most Trusted Broker

Winner: OANDA

Outstanding Achievement: Pepperstone, Interactive Brokers, CMC Markets

Methodology: The Most Trusted Broker award evaluates regulatory oversight, broker reputation, and transparency. We prioritise brokers regulated by Tier 1 authorities like the Australian Securities and Investment Commission (ASIC), the Financial Conduct Authority (FCA), and Cyprus Securities and Exchange Commission (CySEC), ensuring strict compliance with client protection standards. Additional factors include years in operation as a brokerage, user feedback and TrustPilot scores, and a clean regulatory record, reflecting the broker’s reliability and credibility.

OANDA’s global regulatory oversight, proven track record, and commitment to transparency make it the Most Trusted Broker for 2026. With financial services licenses across Tier 1 jurisdictions (including FCA and ASIC), strong client protections, unique risk management tools, and positive TrustPilot reviews, OANDA is a reputable broker worldwide.

#1 Best Broker For Beginners

Winner: Capital.com

Methodology: The best brokers for beginners were evaluated using four main criteria.

The first criteria is ease of use and platform simplicity. Brokers scored higher if their trading platforms easy for beginners to use. This include ability to easily place trades, manage positions, and monitor risk without unnecessary complexity.

The second consideration is educational resources and learning tools. We assessed the quality and depth of beginner-focused education, including trading guides, video tutorials, webinars, demo accounts, and market explainers. Brokers offering structured learning paths and risk-free practice environments scored higher.

The third weighting is costs and accessibility. Brokers with low minimum deposit requirements, competitive spreads and transparent pricing structures ranked higher, as these features reduce barriers to entry for new traders.

The final criterion is risk management tools and customer support. Brokers that offer strong risk management features such as guaranteed stop-loss orders, negative balance 4protection, and clear margin controls scored higher, as these tools help beginners manage downside risk. We also considered the availability and responsiveness of customer support, which is critical for new traders.

#1 Best CFD Broker

Winner: Eightcap

Outstanding Achievement: Pepperstone, FP Markets, BlackBull Markets

Methodology:The #1 Best CFD Broker award highlights brokers offering extensive CFD markets, competitive costs, and reliable platforms. Our evaluation considered trading costs like spreads and commissions, regulatory compliance, and platform usability. A key focus was on the range of CFDs available, including forex, shares, indices, commodities, and cryptocurrencies, ensuring the top brokers provide traders with diverse opportunities across multiple asset classes.

#1 Best Copy Trading Broker

Winner: eToro

Outstanding Achievement: Pepperstone, IC Markets

Methodology: We evaluated brokers offering copy trading platforms, focusing on tools that empower traders to replicate experienced traders strategies with ease. The selection process prioritised platforms with user-friendly interfaces, a wide range of signal providers, and features like verified track records and risk management tools. We also considered trading costs, execution speeds, and platform reliability to identify the best brokers for this award.

eToro, the category winner, is known globally for providing the most innovative copy trading tools as well as solid risk management tools to support both beginner and experienced traders.

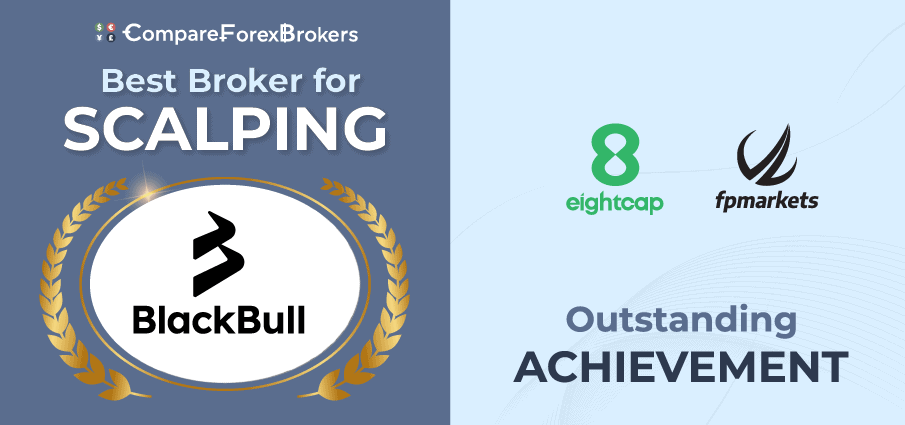

#1 Best Broker for Scalping

Winner: BlackBull Markets

Outstanding Achievement: Eightcap, FP Markets

Methodology: The Best Broker for Scalping award recognises brokers that cater to the specific needs of high-frequency traders. Our team tested execution speeds, spreads, and platform functionality across multiple brokers.

The winner demonstrated ultra-tight spreads, low latency, and advanced tools, creating the optimal environment for scalping strategies. By providing fast order execution and access to robust trading platforms like MT4, MT5, and cTrader, the winning broker ensures traders can maximise opportunities from small price movements.

BlackBull Markets stands out as the top broker for scalping, offering unmatched execution speeds (72 ms for limit orders) and raw ECN spreads starting at 0.14 pips. With commissions as low as $3 per lot round turn on the ECN Prime Account and leverage up to 500:1, the broker creates a cost-efficient, low-latency trading environment.

Scalpers benefit from its direct access to Tier 1 liquidity providers, VPS services for minimal latency, and strategically placed data centres. The platform options—MT4, MT5, cTrader, and TradingView—provide advanced tools and flexibility essential for precision in high-frequency trading.

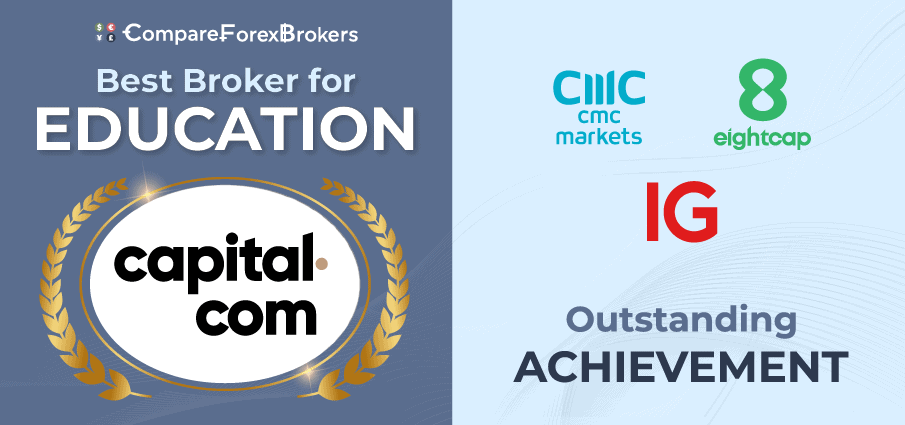

#1 Best Broker for Education

Winner: Capital.com

Outstanding Achievement: CMC Markets, Eightcap, IG Group

Methodology: Our team recognises the importance of quality education for traders at all experience levels. To determine the winner for the best education award, we evaluated brokers on their beginner-friendly resources, intermediate and advanced training, and delivery channels like webinars, eBooks, blogs, and video tutorials.

Brokers offering market research, in-house analyst insights, and a comprehensive glossary earned higher scores. This award highlights brokers with top-tier learning materials designed to empower traders to make informed decisions.

#1 Best Broker for Weekend Trading

Winner: IG Markets

Outstanding Achievement: FXCM

Methodology: The Best Broker for Weekend Trading award highlights the brokers that enable seamless trading opportunities outside regular market hours. Our team tested brokers offering weekend trading on forex, indices, and cryptocurrencies, evaluating execution speeds, platform reliability, and the availability of key markets.

The winner demonstrated superior access to weekend markets, minimal downtime, and competitive spreads, ensuring a reliable trading experience for those seeking to capitalise on opportunities seven days a week.

Regional and Country Awards

Our Country and Regional Awards spotlight brokers with strong local performance and regulatory compliance, ensuring traders can trust their chosen broker. These awards prioritise brokers regulated by reputable authorities like ASIC, FCA, or CySEC, which enforce strict standards to protect traders and uphold transparency.

By focusing on regulated brokers, we aim to provide traders with options that deliver security, quality platforms, and tailored services for their region.

2026 Overall Rankings Table

| Broker | Our Rating | Trading Costs | Trading Experience | Trading Platform | Trust | Range of Markets | Customer Service |

|---|---|---|---|---|---|---|---|

| Pepperstone | 98 | 8.5 | 10 | 10 | 9 | 9.5 | 10 |

| Eightcap | 96 | 10 | 10 | 10 | 8.5 | 10 | 10 |

| BlackBull Markets | 94 | 9 | 10 | 10 | 6 | 10 | 9 |

| OANDA | 92 | 9 | 8 | 8 | 10 | 9 | 10 |

| Fusion Markets | 91 | 10 | 10 | 9 | 6 | 8 | 8 |

| IC Markets | 90 | 9.5 | 8 | 9 | 8 | 9 | 9 |

| Interactive Brokers | 88 | 10 | 7 | 5 | 10 | 10 | 7 |

| FP Markets | 86 | 8 | 8 | 9 | 6 | 7.5 | 10 |

| XM | 83 | 6 | 9 | 6 | 9 | 8.5 | 10 |

| Capital.com | 82 | 7 | 7.5 | 8.5 | 8 | 9 | 9 |

| MultiBank Group | 81 | 7.5 | 7.5 | 8 | 9.5 | 8.5 | 8.5 |

| ThinkMarkets | 80 | 8 | 8 | 7 | 8 | 8 | 7 |

| Trade Nation | 79 | 8 | 8 | 8 | 8 | 7 | 6 |

| GO Markets | 78 | 9 | 8 | 8 | 6 | 8 | 6 |

| IG Group | 77 | 5 | 7 | 6 | 10 | 10 | 7 |

| Tickmill | 76 | 10 | 8 | 3 | 6 | 8 | 6 |

| Exness | 75 | 7.5 | 7 | 6 | 4 | 8 | 8 |

| FXCM | 74 | 5 | 7 | 9.5 | 7 | 10 | 9 |

| FOREX.com | 73 | 5 | 8 | 7 | 9.5 | 7 | 7 |

| City Index | 73 | 5 | 8 | 7 | 9.5 | 7 | 7 |

| PU Prime | 72 | 8.5 | 8 | 7 | 5 | 7 | 8 |

| Admiral Markets | 69 | 7 | 5 | 5 | 7 | 7 | 6 |

| CMC Markets | 68 | 5 | 5 | 3.5 | 9 | 10 | 3 |

| Plus500 | 67 | 6 | 9 | 5 | 9 | 8 | 8 |

| VantageFX | 66 | 7 | 7 | 8 | 6 | 8 | 7 |

| TMGM | 65 | 8 | 7 | 6 | 5 | 5 | 7 |

| FBS | 64 | 6 | 9 | 6 | 6 | 8 | 6 |

| HYCM | 63 | 6 | 7 | 6 | 6 | 6 | 4 |

| RoboForex | 62 | 8.5 | 6 | 7 | 4 | 7 | 4 |

| IUX | 61 | 7 | 7 | 8 | 4 | 8 | 7 |

| AvaTrade | 60 | 4 | 8 | 6 | 7 | 8 | 7 |

| Axi | 59 | 8 | 5 | 3 | 6 | 8 | 6 |

| FxPro | 57 | 3 | 5 | 8 | 6 | 9 | 6 |

| Blueberry Markets | 56 | 6 | 6 | 5 | 4 | 6 | 7 |

| Saxo | 55 | 5 | 7 | 3 | 8 | 7 | 5 |

| FXTM | 54 | 5 | 6 | 5 | 6 | 6 | 4 |

| Global Prime | 54 | 6 | 6 | 4 | 4 | 8 | 6 |

| Octa | 53 | 4 | 8 | 5 | 3 | 8 | 5 |

| eToro | 52 | 3 | 6 | 4 | 8 | 7 | 5 |

| Markets.com | 51 | 4 | 4 | 6 | 7 | 7 | 5 |

| Trading.com | 50 | 4 | 5 | 3 | 7.5 | 5 | 4 |

| XTB | 49 | 5 | 6 | 4 | 5 | 7 | 4 |

| HFM | 48 | 3 | 5 | 6 | 7 | 7 | 3 |

| ACY Securities | 47 | 3 | 7 | 5 | 6 | 8 | 9 |

| Doo Prime | 46 | 5 | 5 | 7 | 3 | 7 | 8 |

| GoFx | 45 | 4 | 7 | 5 | 3 | 6 | 5 |

| Startrader | 44 | 3 | 5 | 5 | 7 | 6 | 5 |

| Chales Schwab | 43 | 2 | 4 | 4 | 10 | 9 | 2 |

| Mitrade | 42 | 2 | 7 | 3 | 7 | 7 | 5 |

| Libertex | 41 | 3 | 5 | 5 | 4 | 8 | 7 |

| GMI Markets | 39 | 2 | 4 | 6 | 3 | 6 | 2 |

| Accendo Markets | 38 | 3 | 6 | 2 | 4 | 6 | 9 |

| IQ Option | 37 | 4 | 5 | 2 | 4 | 5 | 4 |

| ATC Brokers | 36 | 5 | 4 | 1 | 4 | 4 | 3 |

| Hankotrade | 35 | 5 | 8 | 6 | 1 | 6 | 5 |

| easyMarkets | 32 | 2 | 3 | 2 | 2 | 2 | 2 |

| Swissquote | 29 | 2 | 4 | 5 | 8 | 6 | 2 |

| Trading 212 | 28 | 2 | 4 | 2 | 6 | 8 | 3 |

| Ox Securities | 27 | 4 | 4 | 5 | 4 | 5 | 2 |

| Capex | 26 | 1 | 3 | 3.5 | 4.5 | 6 | 2 |

| Purple Trading | 25 | 3 | 3 | 7.5 | 4 | 6 | 2 |

| KOT4X | 24 | 6 | 3 | 3 | 1 | 6 | 2 |

| Tradersway | 23 | 6 | 4 | 5 | 1 | 3 | 1 |

| Hugo's Way | 22 | 5 | 4 | 3 | 1 | 5 | 1 |

| Fondex | 21 | 4 | 2 | 2 | 1 | 6 | 3 |

Ask an Expert